Get time right with the best employee time tracking software

Automated time and attendance tracking software for better bottom lines and happier teams.

Time tracking is complicated. Your software shouldn’t be.

TimeClock Plus saves you time, reduces costly errors, and makes work life easier for your employees and managers. It’s a win-win-win.

Collect time from anywhere

Capture time and payroll data across locations, including punches, employee details, contracts, and rules.

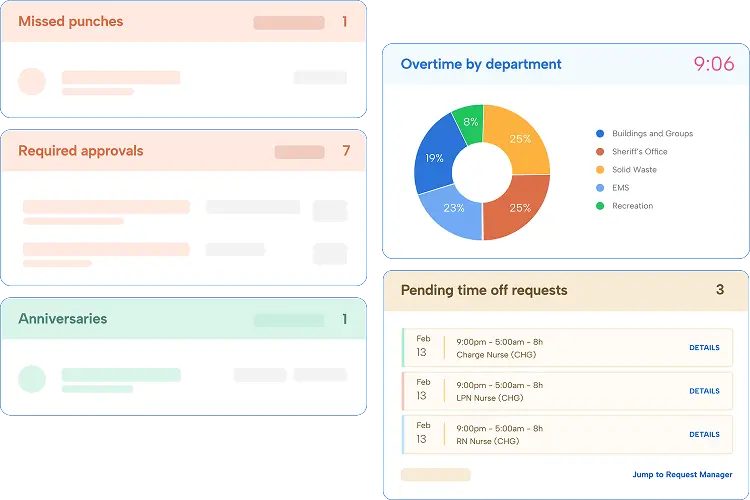

Manage and track employee work hours

Manage hours worked, breaks, leave requests, exceptions, accruals, overtime, job codes, pay rates, and more.

Deliver the perfect paycheck

Automate complex payroll calculations for precise payroll in a fraction of the time.

Time keeping software

Your time, tracked for how your teams work

The best time tracking software helps you avoid payroll mistakes, control labor costs, and handle even the most complex pay rules, compliance policies, and workforces.

Learn about time tracking with TimeClock Plus

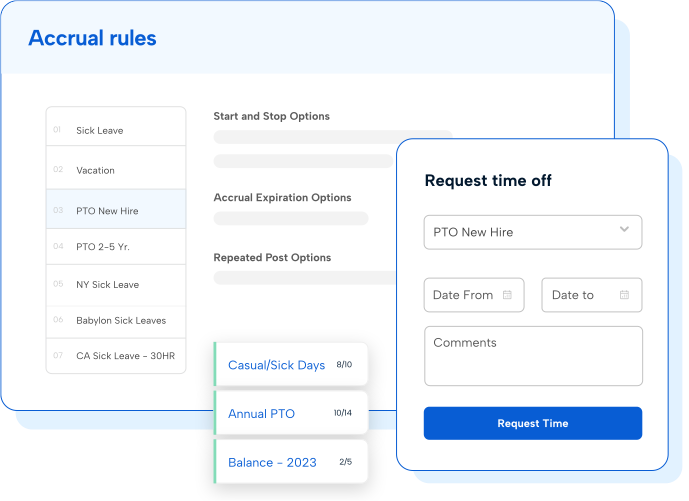

Leave & accrual management

Easier leave management for everyone

From PTO and FMLA to holiday and sick time, TimeClock Plus makes it easy for employees to request time off and for managers to review.

Explore leave and accrual management

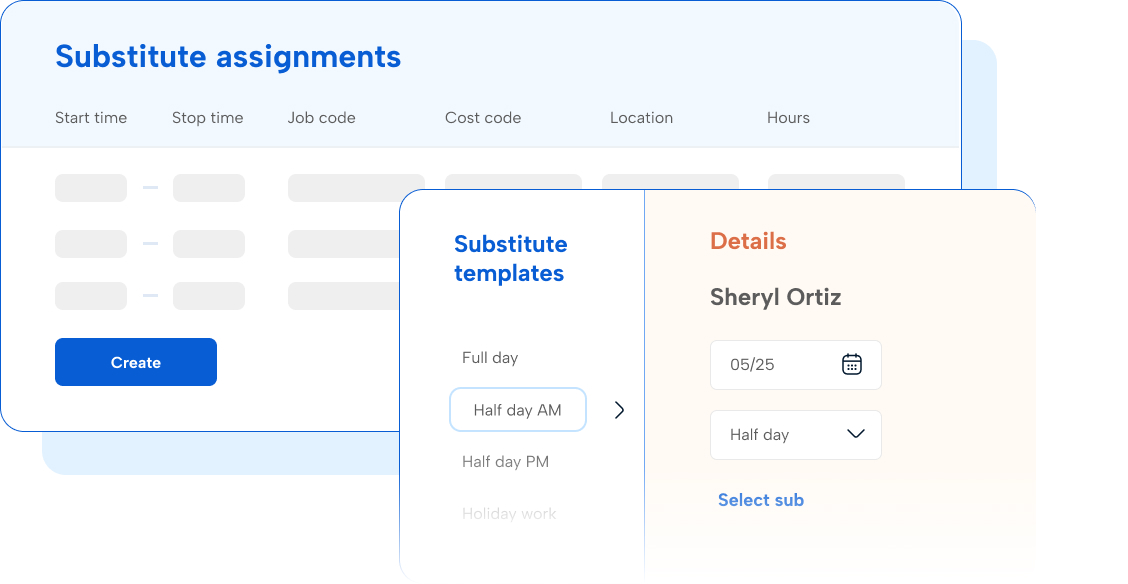

Resource management

Every hour, all in one spot

Bring your time clock attendance tracking, absence management, and extra duty tracking into the best time tracking software for K-12 resource management that’s loved by teachers, admins, and subs alike.

Learn more about resource management for schools

Time clock hardware

Made-for-you time clocks

Whether you need on-site, mobile time tracking, or web clocks, pick the time clocks for employees that confidently track hours with ‘mix and match’ devices.

See which time clocks are right for you

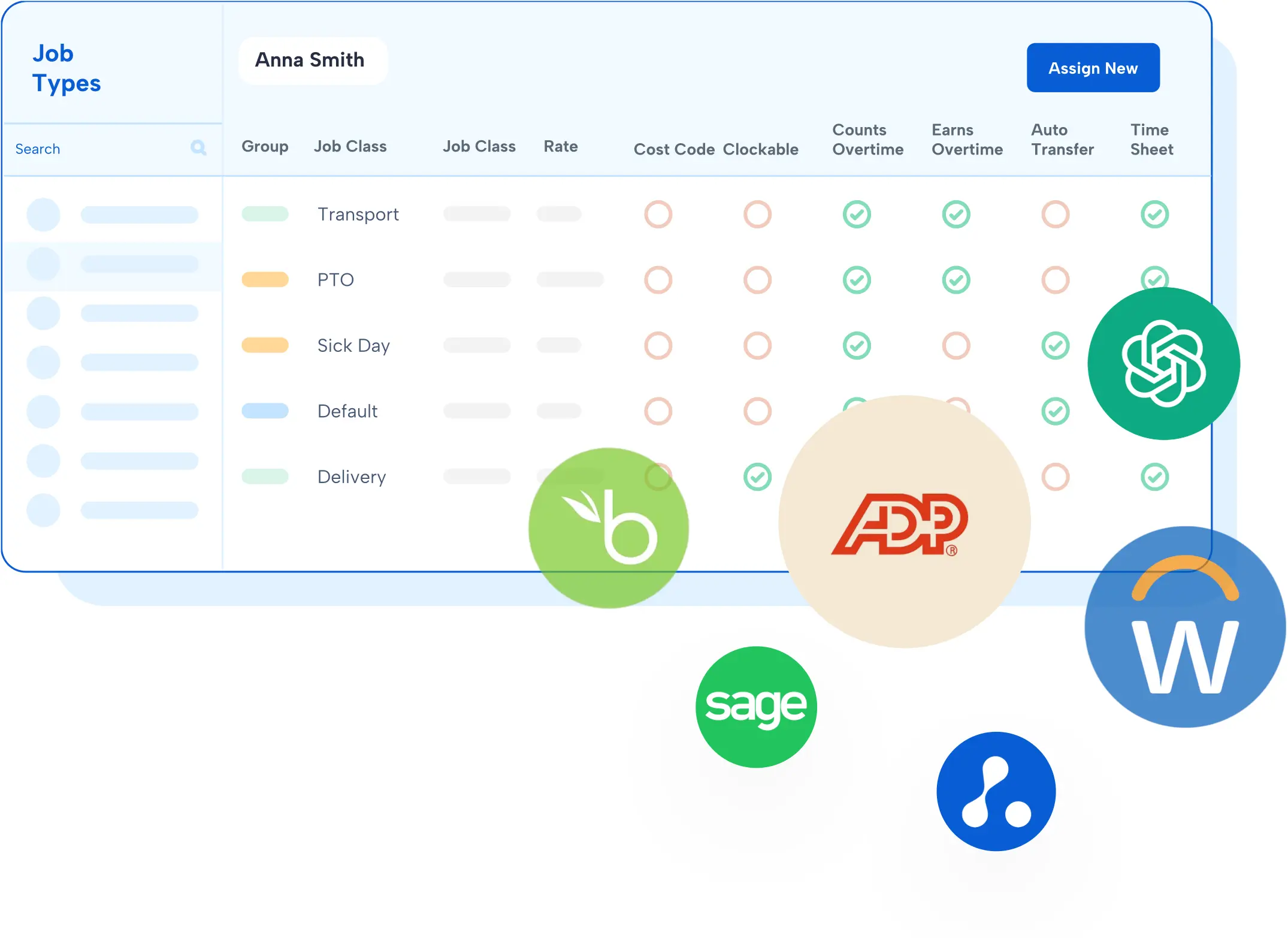

Integrations

Connect with your existing systems

From major providers to custom setups, we play nicely with the payroll and HR systems you already use. Looking for multiple TCP solutions? We connect those too.

Explore our integrations

Enterprise

IndustryK-12 education

Pasco County School District manages labor costs and FLSA compliance with TimeClock Plus

Read their success story

Featured resources

Explore all resources